Today I went to the bank to sign some papers to finalize all the mortgage stuff. I ended deferring the life and disability insurance that they originally put on top of the mortgage amount. It was only $15 a month... so not much... but I've been very cautious about thinking with that mindset because every dollar will begin to count after I move out and start paying those big figure bills (YIKES!). I'm also contemplating on whether to switch out of my current auto insurance with Belair and go with RBC's auto+home insurance package. They say it's cheaper but until I call in and get a quote, I won't make the assumptions that it is. Have any of you switched to your banks plan for auto+home and received substantial savings? I'd like to hear it if you have!

The mortgage specialist was extremely helpful and professional explaining me all the details of the mortgage and even broke down and printed off my scheduled payment. I went with their accelerated bi-weekly plan as it will shave off close to 4 years on my overall mortgage term, saving me just over $9000 in interest costs over the life of the mortgage. Yay!

Later I was introduced to the rep that would be my long-term relationship rep. I thought the specialist would be it, but it appears as though he's was only responsible for getting me qualified and the papers done. This guy was also friendly and professional. I felt like speaking with him that he was a bit tense. Nonetheless he sounded like he knew his thing and he had told me that he's been working at RBC for 8 long years.

We spoke a lot to the other products that RBC offered for people who just qualified for a mortgage. Interesting enough, I learned a lot about what I don't know. You know... You don't know what you don't know... So you gotta learn to know ;)... I wasn't trying to confuse you there.. I swear ;).

So what kinda trouble did I get myself into? A bunch of things and there's a ton I could write here but I will be dividing this blog up into multiple parts, hoping that it stays with me until I blog again :) So to start... here is what I signed up for...

So what kinda trouble did I get myself into? A bunch of things and there's a ton I could write here but I will be dividing this blog up into multiple parts, hoping that it stays with me until I blog again :) So to start... here is what I signed up for...

- I opened up a TFSA.

- I applied for a line of credit.

So the 3 products I have with the bank now...

- Bank account

- Mortgage

- TFSA

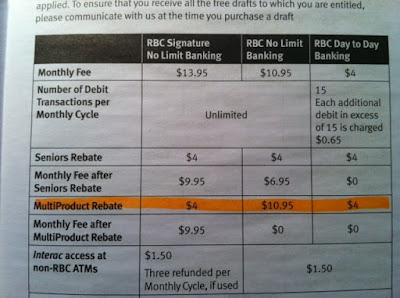

I save on $10.95 a month... Or $131.40 a year :D. That's good enough for a nice piece of furniture each year... hmmm... lol or maybe I will save that for some photography gear / travel.

The last thing I'm going to share here may shock you but I didn't know about this until I asked... actually, that's a lie, he brought it up and then I began questioning him.

You can get a credit line for FREE! Make sure you ask about it because they may just try to charge you. He didn't though. He told me straight up it was free.

So the line of credit option is actually a good product to have because the minimum payment is only the interest rate against the borrowed amount over 12 months. That's very little... Check this out...

- Your credit limit = $5000

- You borrow = $2000

- Interest rate = 7%

- Minimum payment = $2000 * 7% / 12 months = $11.67 a month.

Your minimum amount is only $11.67 a month! The amount is charged to you based on two factors here, the withstanding balance that you borrowed and the interested rate. Keep in mind that you probably wouldn't want to keep paying the minimum, or else you're going to be stuck there foreverrr. But then again... it's better than having that debt on your credit card... why?

Most shocking thing... credit cards is a scam! The interest you pay on your credit card balance is always against the highest amount you had previously not paid in full for. For example,

- Your purchase was $5000

- You pay back to the bank $1000

- You owe the bank $4000 plus interest

- So that must be $4000 x 19.99% (whatever the rate is, but look how high it is)

- The truth is, this is NOT how it works!

The interest rate is actually against the $5000 until you've paid it all off in full!

I wish I could share a real example but I've never actually gone down that path :p If you've endured this can you confirm with me that that is how they scam you? It's frustrating because they never disclosed that to me. I guess the think about credit cards is that almost anyone can apply for one and it's very easy to get approved. But what they don't tell you can hurt you over the short/long term if you are not careful. Take that as a cautionary note, I really hope you do!

I'll leave the life and disability insurance thing for another post because I think it deserves a lot of writing about that topic with some fancy graphs and stuff :)

Until next time, subscribe to my blog!

No comments:

Post a Comment